Markets tumbles again as coronavirus fears dominate – as it happened - MW

One last thing: despite a late mini-recovery, Wall Street has closed in the red.

The Dow Jones Industrial Average ended down about 253 points or 1%, while the S&P 500 lost about 52 points, or 1.7%, to close near 2,972.

So, a poor day. But thanks to strong gains on Monday and Wednesday, the Dow finished the week up 1.8%, while the S&P 500 rose 0.6%.

Goodnight! (Again)

Summary: Markets slide again

Time for a recap, after another turbulent week.

Fears of a global recession triggered by Covid-19 have sent stock markets slumping again today.

Britain’s FTSE 100 has tumbled by 3.6% in another wave of selling; it shed 242 points to close at 6462, the weakest since July 2016.

Wall Street is being pummelled too, as the number of coronavirus cases in America continues to rise.

The main indices are at their lowest levels since last summer;

- Dow: down 566 points or 2.3% at 25,521

- S&P 500: down 92 points or 3% at 2,903

- Nasdaq: down 293 points or 3.3% at 8,445

The scramble into safe-haven bonds has driven US and UK government bond yields to record lows.

Oil has plunged after Opec and Russia failed to agree production cuts, to address falling demand due to the virus outbreak.

German airline Lufthansa has halved capacity, as analysts warned that Norwegian airlines is suffering too.

The US economy has created 273,000 jobs last month - more than forecast. Panicky investors took little notice.

Goodnight, and have a lovely weekend! GW and JJ

The UK government has asked supermarkets to increase availability of home delivery services to help people in self-isolation with coronavirus get access to food and other essentials.

My colleague Sarah Butler explains:

Top supermarket executives held a call with George Eustice, the secretary of state for environment, food and rural affairs on Friday afternoon. The teleconference came after the health secretary, Matt Hancock, claimed he had been in touch with supermarkets and he was “confident” food supplies would not run out.

However, several supermarket executives told the Guardian that until Friday there had been no communication from the government about managing potential shortages during the outbreak.

Ben Chu of the Independent has written about how rising anxiety about the economic impact of the global Covid-19 outbreak has driven the yield (or interest rate) on government debt to record lows:

The recent dip is certainly driven by fears about the threat of a pandemic.

Traders expect the Bank of England to be forced to cut interest rates relatively soon to try to help support the UK economy in the face of this shock.

Reductions in the official short-term Bank interest rate tend to reduce traded UK government bond yields.

Also, with stock markets tanking, there’s generalised fear about holding riskier assets.

Blimey. Interest rates on UK govt debt now down to lowest level EVER. 10 year govt bond yield down to 0.236%.

What does this mean? @BenChu_ has a good explainer here: independent.co.uk/news/coronavir… but in broad terms: it's a sign of extreme COVID-19 nervousness among investors

What does this mean? @BenChu_ has a good explainer here: independent.co.uk/news/coronavir… but in broad terms: it's a sign of extreme COVID-19 nervousness among investors

Tom di Galoma, managing director of Treasurys trading at Seaport Global Securities, says stocks are falling because:

“The COVID-19 infection rate is multiplying and more states in the U.S. are imposing emergency orders”.

Stocks are sliding as the number of coronavirus cases in the US keeps rising, with 33 now reported in New York state.

New York state coronavirus cases triple over 48 hours to 33 people infected; thousands under ‘precautionary quarantine’ cnbc.com/2020/03/06/new…

The broad index of US stocks is currently down 2.6%, or 78 points, at 2,947. It was briefly lower last week, but closed lower since mid-October 2019.

Oil producers, banks and tech stocks are the worst-performing sectors, with miners trudging lose behind.

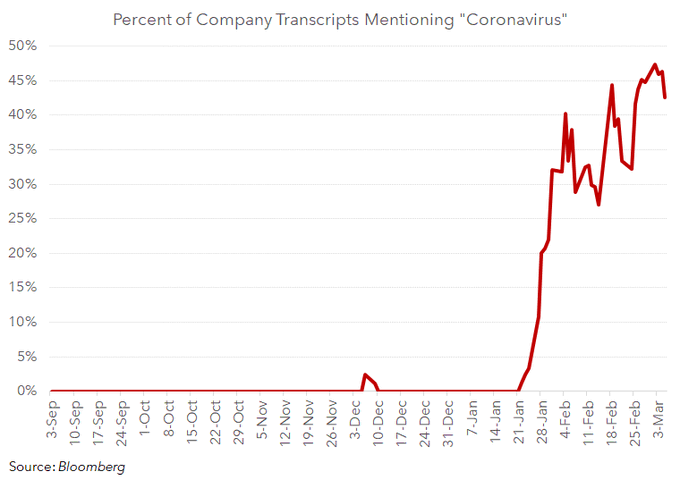

Nearly half of companies have mentioned Coronavirus in their recent financial reports, spots Michael McDonough of Bloomberg (and very few, if any, were positive mentions, I bet)

Percent of transcripts from company earnings calls and presentations mentioning "Coronavirus" (daily):

See Michael McDonough's other Tweets

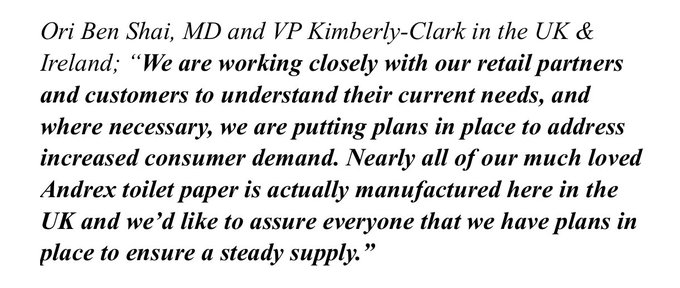

The firm behind toilet roll brand Andrex says it is taking steps to ensure supplies are available, after stock-piling and panic buying this week:

Andrex reassures the nation on supplies of toilet paper, which are “nearly all” made in the UK

A little context:

This week had started with some optimism that the coronavirus outbreak might be contained, and that government and central banks might steer their economics through the weeds.

Those hopes have fizzled in the last couple of days, though, as cases of Covid-19 have jumped in the US, the UK and Europe.

Most stocks have suffered, but there are some serious casualties in London, as Russ Mould, investment director at AJ Bell explains:.

Investor fears that appetite would wane for spring and summer holidays resulted in TUI’s shares falling by 37% in value over the past two weeks. The sharp decline in its valuation cost the travel company its place in the FTSE 100 with the result of quarterly reshuffle demoting the business to the FTSE 250 index.

“Outsourcing group Capita lost 47% of its value over the past week after its restructuring was costing more and taking longer than expected.

“Cineworld failed to convince the market that it was in good health. The postponement of the latest James Bond film, together with growing concerns about its very large amount of debt linked to two major acquisitions, led investors to worry about the state of the business. Its shares fell nearly 30% over the week.”

After tumbling again today, European stock markets have closed at their lowest point since August 2019.

The Stoxx 600 has closed 3.7%, as the nervous recovery earlier this week was wiped out in heavy selling yesterday and today.

Energy stock were the worst hit, after today’s oil output cut deal collapsed.

MW

No comments