Coronavirus live updates: stock markets plunge on global recession fears - MW

Goldman Sachs cut its second- and third-quarter Brent price forecasts to US$30 per barrel, citing the oil price war between Russia and Saudi Arabia and a significant collapse in oil demand due to the coronavirus.

Oil plunged the most since 1991 on Monday after Saudi Arabia began a price war with Russia by lowering its prices and pledging to release pent-up supply into a whirling market due to falling demand as a result of falling demand. virus outbreak.

The sharp cuts to Saudi and Russian Official Official Prices are reluctant to be pushed into a deal on Friday with the low probability of an agreement (OPEC +) immediately, noted in a date note. March 8.

A three-year treaty between the Organization of Petroleum Exporting Countries and Russia ended well on Friday after Moscow refused to support further cuts and OPEC responded by removing all restrictions on oil. their own production.

Assuming there is no change in production policy, Goldman expects supply deficits to appear in the fourth quarter of 2020, which will reduce excess inventories by 2021.

The bank said the prospect of withdrawing inventories would help prices rise back to 40 USD / barrel by the end of this year.

In Australia, Sky News has reported that Prime Minister Scott Morrison is considering cash handouts to ordinary citizens as part of an expected A$10 billion (US$6.50 billion) fiscal stimulus package.

However, the idea is facing fierce opposition from Finance and Treasury officials, Sky added.

Also on the table are wage subsidies for small businesses and business tax incentives as Morrison’s government work to combat the economic impact of the coronavirus outbreak.

Australia ‘set up for recession

Here, more about the ASX decline today. Bloomberg Economy says the country is facing recession: Australia's economy will record the first recession since 1991 due to the influence of China's virus decline amplified by the decline in confidence. news and domestic disruptions from the Down Under outbreak, according to Bloomberg's James McIntyre. .

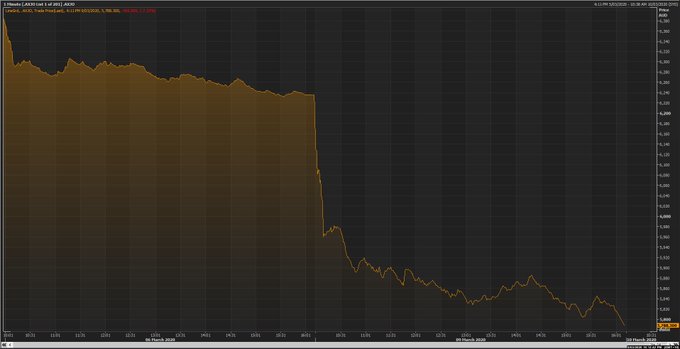

Australia stock market closed down 7.33%, the worst trading day since GFC

The Australian stock market has suffered the worst day since the global financial crisis, with about $ 140 billion removed from the market over concerns that a widespread outbreak of Covid-19 might be causing the Australian economy to decline, reported by Katharine Murphy and Ben Doherty.

Australia's ASX200 stock index market closed down 7.33% on Monday, down 455 points to 5,760 points. It is estimated that the total value loss from the market is about 140 billion dollars. ASX 200 reached an all-time high of 7,197 on February 20.

Oil inventories slumped and oil prices fell more than a fifth after Saudi Arabia reduced official prices and announced they would increase output. According to some forecasts, retail gasoline could be as low as 1 dollar a liter in Australia.

The Australian dollar was pulled into the sell-off and traded as low as 63.98 US cents.

The confirmed cases of Covid-19, mostly among those who have traveled abroad, continue to grow across the country.

New South Wales currently has 46 confirmed cases, including three students, Queensland and Victoria 15 cases. There are currently 91 cases across Australia, with three deaths.

Australian Treasurer Josh Frydenberg said the Morrison government would use the tax and transfer system to provide financial support to Australian households as quickly as possible as part of a stimulus package to counteract the impact. negative economics of coronavirus, Katharine Murphy and Amy Remeikis.

Before a cabinet discussion about the stimulus package scheduled for Tuesday, the cashier was asked by reporters on Monday about how the government planned to administer support to households, as the Alliance had criticized the Rudd government stimulus package deployed during the global financial crisis.

The ASX just closed with a 7.33% plunge, in the worst day of trading since the Global Financial Crisis. This represents around AU$140bn (US$90bn) being wiped off Australian shares. More soon...

The ASX is down 7.9%. Markets will be closing any minute now. We’ll have more exact figures soon, but this represents more than AU$130bn (US$85bn) being wiped off the Australian share market. This is the worst day of trading since the 2008 Global Financial Crisis.

The mutual travel restrictions imposed by South Korea and Japan came into effect on Monday, arousing diplomatic and economic feuds between old enemies.

South Korea suspended its visa and visa-free visa for Japan on Friday, after Tokyo announced restrictions on travel, joining more than 100 other countries restricting visitors from South Korea.

The spit, coupled with a change in oil prices, sent South Korean stocks and the currency plummeting and prompted the finance ministry to issue verbal warnings against market volatility.

South Korean officials expressed hope on Monday that the country was nearing a “turning point” in the crisis, as the pace of new infections trended lower.

The Korea Centers for Disease Control and Prevention reported 69 new cases, continuing a downward trend. The death toll rose by one to 51

The new cases brought South Korea’s total infections to 7,382, while the death toll rose by one to 51, the KCDC said.

The rate of increase in new infections fell to its lowest in 10 days on Sunday in one of the countries most severely affected outside mainland China.

“I’m still extremely cautious, but there’s hope we can reach a turning point in the near future,” Prime Minister Chung Sye-kyun said on Monday before returning to Seoul from the hard-hit southeastern city of Daegu.

Health authorities say the number of new infections being identified has dwindled as most of the roughly 200,000 followers of a fringe Christian church at the centre of the epidemic in Daegu have now been tested.

MW

No comments