Wall Street plunges again as Trump's EU travel ban sends shares crashing - business live - MW

The market crash is causing investors to rush to buy dollars.

This has caused the pound to spin, dropping 2 cents today to $ 1.26 - the lowest level since October.

Trading was briefly halted in Brazil, where shares fell another 10%.

Brazil stock market trading halted after 10% fall triggers circuit breaker. Bovespa now down 35% this year (over 45% in dollar terms).

29 people are talking about this

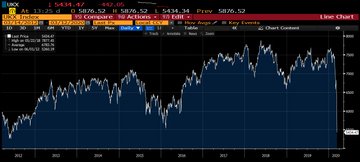

FTSE 100 tracks for the worst day since 1987

It was another horrible day on the market, turning into the most gloomy sell-off we've seen since the crisis began.

The FTSE 100 index is on track for the worst fall in a day since 1987. Worse than Monday's plunge. Worse than any other day in 2008 after the failure of Lehman Brothers.

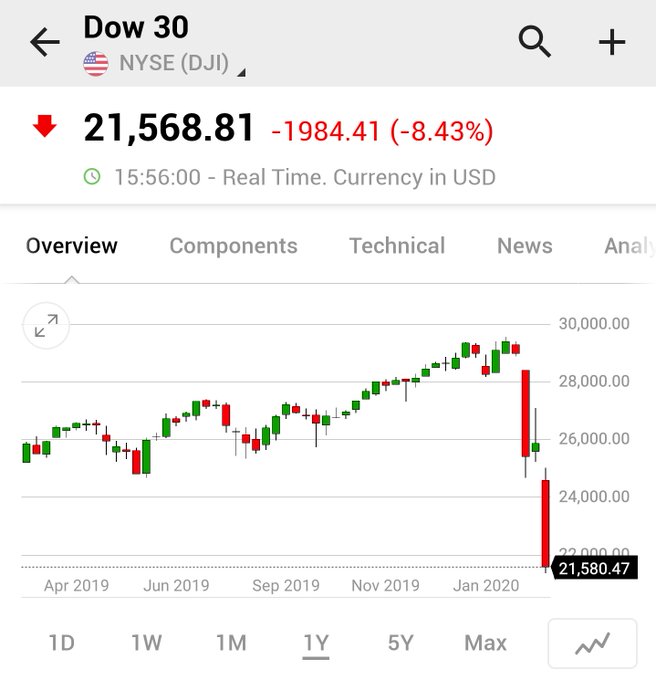

Right now, here, the situation:

- The index dropped: 2,015 points or 8.5% decreased to 21,537

- FTSE 100: decreased by 540 points or 9.1% to 5322

That brings the index to a new one-year low, and shows the severity of this market collapse.

Investors are becoming petrified by the worldwide economic downturn, coronavirus epidemic, widespread losses that companies are unable to repay.

And Donald Trump's statement, last night obviously did not provide reassurance or support.

FTSE 100 drops 9% on regular boost

The news that trading was suspended on Wall Street caused a monster sell-off in Europe.

FTSE 100 has dropped by 9%, dropping 546 points to 5,330.37 - an unprecedented level since 2012.

The European stock market has risen 10% - it will be a worse day than ever for EU companies' Stoxx 600 index.

STOXX Europe 600 extends declines, now down 10%, the biggest ever decline #EUstocks50 on IG platform#MarketSlump

Wall Street suspended as shares plunge 7%

NEWSFLASH: Trading has been briefly suspended on the US stock exchange, for the second time this week.

Automatic circuit breakers kicked in shortly after the open, at 9.30am New York (1.30pm UK), when the S&P 500 index plunged 7%.

The Dow has also plunged 7%, losing 1,696 points to 21,856 in opening trades. Investors are clearly more worried than ever about a global recession and a Covid-19 pandemic, following president Trump’s shock EU travel ban announced late last night.

That activates a 15-minute suspension (as happened on Monday).

US underlying markets suspended for 15 minutes to reset circuit breaker, after cash market opened down 7%

See IG's other Tweets

The top faller on the FTSE 250 is Finablr, which runs Travelex. Shares are down 66% (!) after it warned it might struggle to access cash needed to manage its business as well as negotiate longer term financing.

Restaurant Group, which runs Frankie & Benny’s, Garfunkel’s and Wagamama, are down 23%. Clearly it would suffer from mass self-isolation in the coming weeks...

...as would airport food operator SSP, who are down 19%.

Shares in UK train and bus operators are slumping today, after Go-Ahead warned the coronavirus would hurt profits.

National Express are down 18%, First Group has lost 17%, Stagecoach are off 12%, and Trainline are down 11%. Their revenues would all suffer if fewer people travel into work (as seems imminent).

Go-Ahead itself is down 30%, making it one of the big fallers on the FTSE 250.

MW

No comments