Stock markets fell sharply due to the viruscorona epidemic - MW

Stock markets across the Asia-Pacific are struggling again as investors seem overwhelmed by the sketchy details provided by the Trump administration about a possible stimulus package.

Australia ASX200 was the biggest loser, down 2.2%, while Tokyo lost 1% and Seoul lost 1.2%. In Hong Kong, stocks fell slightly but in Shanghai they increased 0.3%.

Eleanor Creagh, an economist at Saxa Capital Market in Sydney, said it was difficult to predict where the market would go because the data on coronavirus outbreaks every day and not clear on the extent of US outbreaks.

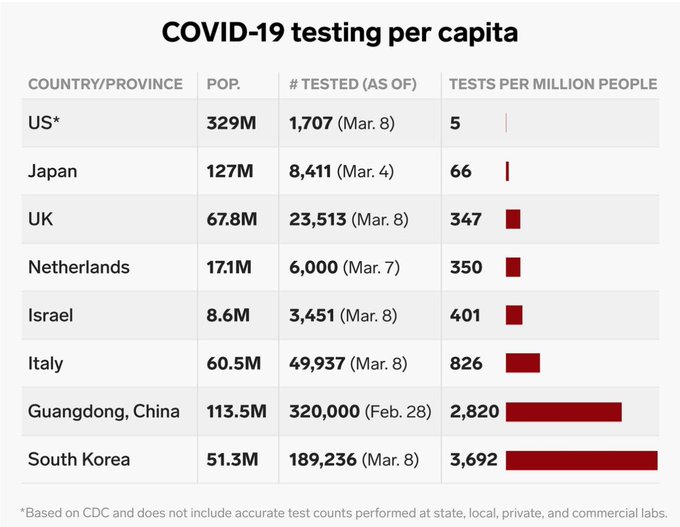

case count in the US will be vastly understated! twitter.com/IndexMacro/sta…

After coronavirus spreads globally, economic ramifications have only just begun. The more time it takes, the actions of governments will become more active and entail the economy and at risk of crisis.

There are new developments every day but from what we know we are in a technical recession in Australia. But then there was the knocking effect on consumers and economic activity. Consumers are becoming more afraid of losing their jobs and that confidence will be difficult to recover.

Economists at the S&P ratings agency have become the latest to predict Australia will fall into recession this year because of the coronavirus outbreak, which they say will strike the country harder than the financial crisis. Global.

The agency said Australia's AAA credit rating is not immediately threatened from the current technical recession and the financial costs of the impending government stimulus package.

A recession is often defined as a period of six months during which the economy shrinks. We believe that the Australian economy will turn into recession in June 2020 and only grow by 1.2% in 2020 before recovering again, '' said S&P in a newsletter to customers.

This is the weakest economic outlook in the past 20 years and means that the Covid-19 boom will be a greater economic shock to Australia than the global financial crisis, when growth slows to 1.6% in 2008.

It said its forecast did not include any impact from the government stimulus package expected tomorrow because a few details are currently available.

A significant stimulus package will support short-term economic results and could help the country avoid contractions in the fourth quarter of 2020 and technical recession, according to Mr. S&P. The course will also weaken the Australian government's budget.

7h ago Australian market falls by 1.3%

The Australian market is continuing to slide, falling by about 1.3% shortly after 11am.

Airline Qantas, which has cut its international capacity by a quarter because of the coronavirus, has again been hammered, plunging more than 9% to make it the biggest loser among the top 200 companies listed on the ASX in trading so far today.

Nickel producer Western Areas is the second-biggest loser, shedding about 7.7%, and fellow miner Newcrest has the third-biggest drop of the morning, off about 6.9%

But pretty much all sectors are down, with only health care in the black so far.

The benchmark ASX200 index fell 0.59% shortly after trade opened on Wednesday morning.

Overnight, Australian time, US markets were up around 5% but the London exchange’s FTSE index recorded a small fall of 0.1%.

Australian stock market closes 3% down

The Australian market looks to be closing in on a fall of about 3% for the day amid scepticism about Donald Trump’s ability to rescue the US economy and renewed warnings Australia is likely to fall into a recession this year.

Movement tomorrow will depend on what the US market does overnight and market reaction to a stimulus package expected from the Australian government.

Meanwhile, the corporate regulator has postponed its annual shindig, which was to be held in Sydney in a fortnight.

The Australian Securities and Investments Commission said it made the decision to postpone the forum due to "the uncertain availability of international and interstate speakers and delegates and the evolving situation surrounding the novel coronavirus (COVID-19)".

Hong Kong’s flaghip airline, Cathay Pacific, has reported a huge drop in profits for 2019 as a result of political unrest, and predicted a loss for the first half of 2020.

From Agence France-Presse:

On Wednesday, the airline reported a convertible profit of HK $ 1.7 billion (US $ 220 million) for 2019, a significant reduction from HK $ 2.3 billion. It was done in 2018.

And it has warned of falling red when airlines around the world suffer major tourism disruptions caused by the rapidly spreading global spread of the deadly coronavirus. Patrick We expect to suffer a significant loss in the first half of 2020, Patrick's Chairman Patrick Healy said.

The boom of COVID-19 since January 2020 has led to a challenging operating environment and will adversely affect the group's financial performance and liquidity.

The last time the airline lost money was in the first half of 2018. After that, they embarked on a major overhaul that brought the airline back to black but Cathay found itself hampered by out of control events. .

Australia’s Reserve Bank has said it is too early to predict whether Australia’s economy will shrink in the June quarter, but that low interest rates could help cushion the blow of the global outbreak.

From AAP:

Deputy Governor Guy Debelle on Wednesday said a record low interest rate would support a post-virus recovery in spending even if Aussie households were reluctant to part with their cash as the virus spreads.

“They may not spend it straight away, but it brings forward the day when they will be comfortable with their balance sheets and resume a normal pattern of spending,” Debelle told the Australian Financial Review Business Summit in Sydney.

The bank cut the cash rate to a record low 0.5 per cent on March 3 to help buttress the economy against the impact of the coronavirus outbreak and is widely expected to make it back-to-back cuts next month. That would take the interest rate to a new record low 0.25 per cent and pave the way for alternative policy measures such as quantitative easing.

Debelle reiterated that the central bank expected the virus will deliver a 0.5 per cent hit to GDP via the education and tourism sectors alone in the three months to March, but the rapidly evolving nature of the outbreak meant a mid-term outlook was hard to quantify.

“Clearly we are still only in the early weeks of March, so the picture can change from here,” he said. “It is just too uncertain to assess the impact of the virus beyond the March quarter.”

“(Other nations) too are beginning to suffer significant disruptions, the extent and duration of which is unknown at this time ... The conclusion is that the global economy will be materially weaker in the first quarter of 2020 and in the period ahead.”

MW

No comments